Content

- Deferred revenue vs. unearned revenue

- How to Make Successful Sales Discovery Calls

- Relax—pay employees in just 3 steps with Patriot Payroll!

- Interested in automating the way you get paid? GoCardless can help

- Assets vs Liability: Why Is Unearned Revenue A Liability?

- Deferred vs. recognized revenue

- Unearned Revenue

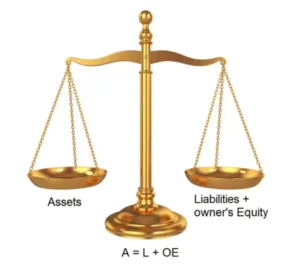

Unearned revenues are a liability until the company delivers products or performs the services. It must be noted that unearned revenue is generally collected as “cash,” so one of the immediately affected accounts against the unearned revenue will be a cash account. When a customer pays https://www.bookstime.com/articles/purchases-journal for a service or a product in advance, it is referred to as “unearned” or “prepaid” revenue. It is recorded as a liability on the balance sheet because it is considered a debt owed to the customer. Prepaid revenue might feel like an asset, but to accountants, it’s a liability.

GAAP accounting metrics include detailed revenue recognition rules tailored to each industry and business type. So recording customer deposits as revenue would lead to inaccurate financial statements that don’t comply with GAAP. The early receipt of cash flow can be used for any number of activities, such as paying interest on debt and purchasing more inventory. The US GAAP given by Financial Accounting Standards Board (FASB) deals with the subject matter of unearned revenue in Accounting Standards Codification (ASC) 606 – Revenue from Contracts with Customers.

Deferred revenue vs. unearned revenue

In your company’s balance sheet, prepayments are recorded as a liability. We will be moving items that have already been record in our books. The deferred items we will discuss are unearned revenue and prepaid expenses. Unearned revenues are money received before work has been performed and is recorded as a liability. Prepaid expenses are expenses the company pays for in advance and are assets including things like rent, insurance, supplies, inventory, and other assets. If a publishing company accepts $1,200 for a one-year subscription, the amount is recorded as an increase in cash and an increase in unearned revenue.

This increases the balance of both the cash and the unearned revenue accounts. When the good or service is delivered, and the revenue is earned, it is recorded as a debit to unearned revenue and is unearned revenue a current liability a credit to revenue. This reduces the unearned revenue account and increases the revenue account. Understanding how unearned revenue impacts a company’s book is an important financial component.

How to Make Successful Sales Discovery Calls

As the product or service is delivered over time, this liability becomes revenue on the income statement. The most common source of unearned revenues is from companies that sell products or services that require a subscription fee or prepayment. If you treat prepaid expenses or revenue like regular revenue, that creates a distorted picture of your finances. Suppose you receive $60,000 in January for services over the coming year.