Content

Additionally, this report can help you make more informed decisions about pricing for future projects. Retainage provides a financial incentive for contractors to complete projects as agreed. If a contractor does not complete the project or delivers substandard work, the customer can use retainage withheld to cover the cost https://www.good-name.org/how-accounting-services-can-help-real-estate-companies-optimize-their-finances/ of repairs or completion of the project by others. Cost of goods sold makes up a substantial portion of a construction company’s expenses. Most purchases are related to projects, either for labor or materials. You should also take advantage of digital routing and approval processes if your accounting software allows them.

Cash flow statements help with forecasting and ensure that you have money to cover your expenses. Cash flow statements break down how much cash entered the business and how much you spent during a given period. Income statements, also known as profit and loss statements, summarize revenue and expenses accrued and the net profit or loss during a period.

Accounting Guide for Construction Contractors

There is no depreciation of the accumulated costs until the project is completed and the asset is placed into service. Additionally, the job cost report can help you identify areas where cost savings could be achieved. The report measures project performance against the original estimates and current costs, allowing you to adjust for future projects. Construction accounting is different from standard accounting and requires a different approach.

In a typical business, revenues are recorded when earned, and expenses are recorded when incurred. However, with a long-term construction contract, an exchange may involve many performance obligations that span several months or years. If revenue is not recognized until all performance obligations are satisfied, this may result in misleading financial information. In order to present an accurate reflection of the company’s finances, construction companies must recognize revenues and costs equally throughout a project.

Construction Work and Bookkeeping

We are a subcontractor and the GC we are working for is asking us to sign and notarize progress payment line waivers for amounts they have not paid us for, is this legal? They are 60 days behind on our payment yet they are refusing to give us… A payment application is a form used to apply for a payment from a client. The general contractor or project owner may provide a specific form that needs to be used to request payment. A cash balance report or cash flow report shows the cash received and expensed during the period the report covers. It’s used for predicting cash needs in the future and to inform business decisions like financing equipment purchases.

- The following are some of the most important considerations that construction management and ownership will want to consider before choosing the best software program for construction accounting.

- These adjustments can cut into or eliminate project profits if the original bid isn’t adjusted for the additional cost.

- Deltek ComputerEase’s dedicated team is committed to providing service excellence and product innovation, adapting to the evolving construction compliance requirements.

- These costs include material, labor, labor burden, equipment rental, and other expenses that are directly related to the project and its administration and management.

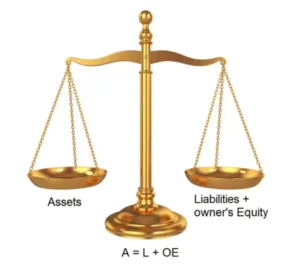

- It’s often used to determine the financial position of a company for lending and credit purposes.

- Before choosing construction accounting software, ensure you’ve identified your company’s needs and the features you’d need to solve them.

Running regular accounts payable reports and scheduling regular payments will help you predict your cash flow needs so you can plan your customer billings and know your cash standing. We offer job costing analysis to help you track the costs of each job or project and to provide you with an accurate picture of the costs the project will accumulate. Increasing your knowledge of the costs of labor, materials, and overhead your project uses will help plan your next project bid. This information is important because it can help with the estimating of your future construction projects of similar nature. Using job costing analysis will lead to better management decisions, project estimation, more profitable projects, and timely financial reporting.

Cost Plus Contract

If you have questions about improving your business model, implementing an accounting practice, or tax planning strategies to improve operations, Smith Schafer can help. With a fixed price contract, the entire cost of a project is one fixed price. Fixed price billing means that you need to identify one price for the materials and labor required to complete a specific project. On the plus side, projects that are completed early or under budget can result in large profit margins. There are varying standard invoicing styles used by contractors to manage different sized projects in different sectors of the construction industry.

These market trends should be considered when evaluating a new accounting and job costing system. They also need to get a wide set of users involved in the selection process so that each user feels invested in the new program and will adopt it when it goes retail accounting live. Finally, contractors need to invest in proper training so that new users get up to speed on the system quickly and realize early benefits from the new system. So take the time to get your construction accounting organized – and keep them that way.